As we sit by and watch the ever-increasing impact of climate change on our world, it stands to reason that startups must also be seeing an increase in interest, investment, and technology innovation to fight this. Yes, this would be reasonable.

The startup scene is never reasonable.

It’s not the 1980’s, kids. We don’t invest in technology or startups with the public good in mind anymore. Big global investments are entirely focused on making money fast — preferably by stealing it from you and me in fees and in turn selling our personal information to others who also want a piece of you and me. It’s rather disgusting, actually.

Want to change this? It’s pretty easy. 1) Require opt-in on personal information. 2) Disallow monopolies to bundle / require opt-in as a requirement for using their software. 3) Eliminate Section 230. Oh, and we might actually eliminate the tax carry loophole used by venture, forcing them to actually do some work.

None of these suggestions are going to happen, folks.

We all are watching what happened in Maui. Fire swept by 60mph winds consumed the entire town of Lahaina in a few hours, taking many in the town completely unaware. Cell service and power were down — obviously, there was inadequate or non-existent backup capability, and old-styles poles were knocked over like dominos — rendering notification impossible. No one thought to use the sirens. The counting of the dead has just begun, and already it has surpassed the death toll from the 2018 Camp Fire in California.

I suppose everyone is now asking “Why didn’t we see this coming?” Well, actually we did and we do. We just can’t get anyone to put money into startups to deal with this threat.

The 2020 CZU Lightning Complex Fires started with a hot wind and dry lightning. I know. I felt the pressure change and awoke. I walked to the screen door and almost fell over from the sudden blast of hot wind from a direction of the mountain wind shadow. William was by my side as we stepped out on our covered porch. William cautioned me to not step beyond the shelter of the porch. We watched the dry lightning start to hit different locations of the surrounding mountains as the wind gusted. And the fires began.

Unlike Maui, CalFire has much more extensive resources for fighting fires. Yet many communities burned to the ground. CalFire was hampered by the rills and gullies inaccessible to conventional firefighting equipment throughout the Santa Cruz mountains. Like Maui, we have been in the midst of long-term drought, so dead fuel was ubiquitous. The winds were strong, but not as strong as Maui.

While power was immediately knocked out for many locations (PG&E also relies on old-fashioned power poles in many mountainous regions), cellular and microwave links were maintained due to adequate battery backup. However, many locations in the mountains are “dead zones” with respect to cellular linkage. For those folks, they relied on house-to-house contact by local authorities and neighbors. Unlike the poor people of Lahaina, the mountain people had more time and more resources to get out, so loss of life was minimized. Loss of property, however, was considerable.

Also unlike the Maui fires, the strikes resulted in fires under the canopies of trees, so air flights dropping retardant and water from the local reservoirs failed to reach the actual fire points. This meant, simply, that small fires could not be staunched before they became big fires. This was a significant opportunity loss.

William and I were among the thousands under mandatory evacuation in the days after the lightning strikes. As we sat in a hotel near Stanford Hospital (William had cancer surgery scheduled that week), William looked up at me and said “You know, I’m tired of this. We could use existing technology to locate the fires. We could use drones to get under the canopy. We can carry retardant to drop on small fires before they become big fires.” And then, he began to put together a business plan to do exactly that.

It wasn’t easy for a man with terminal cancer to begin this process. But William and I were struck by the complete indifference by Silicon Valley companies and venture to the reality of climate change. Oh sure, they put money into charities to help folks after-the-fact. But that’s too-little, too late.

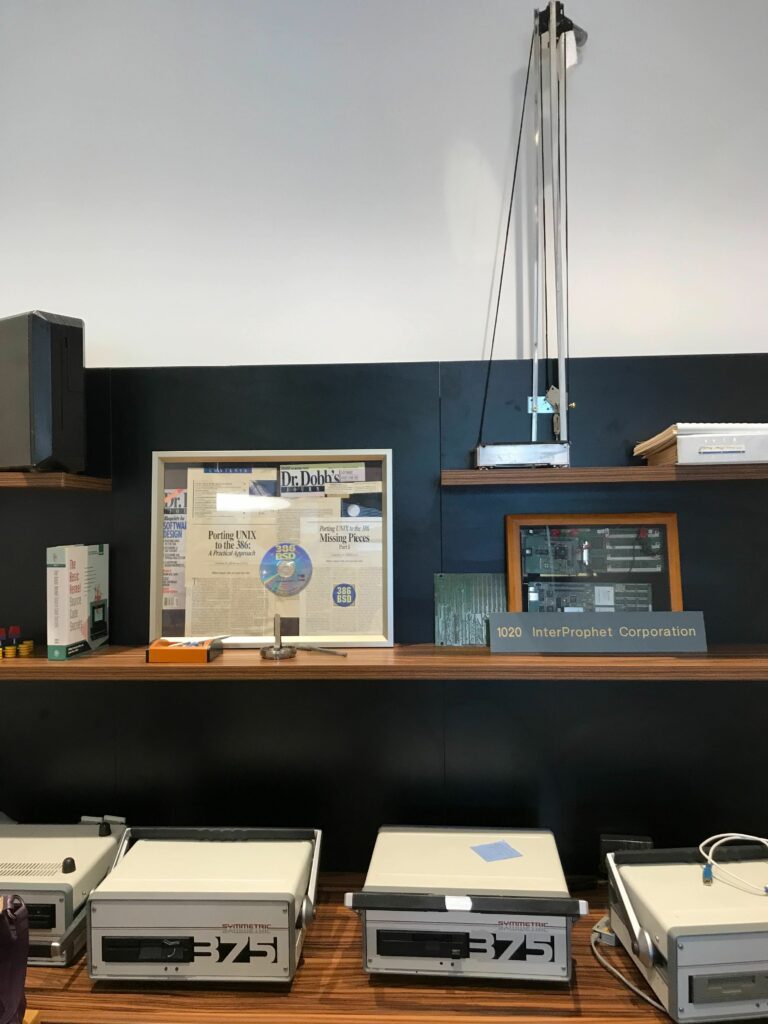

William is a legend in Silicon Valley. He’s the Father of Open Source Berkeley Unix. His work and its progeny are the engines of commerce. Yet he could not get sufficient interest beyond some meetings and happy talk. Apparently, wealthy folks can just relocate to safer locales. It is not a burning concern to these folks.

But with global climate change, is anywhere really safer?

There is actually some movement now on his vision to make a safer world 1-1/2 years after his death. So in this, I am hopeful.

To assist in spotting small fires before they become big fires, UC San Diego is working with CalFire to develop AI mechanisms to essentially sort through various feeds looking for anomalies that may indicate a fire starting.

This is the first item William outlined 3-1/2 years ago as we sat in our hotel room waiting out the fires.

As to drone development, at the time William was putting together his funding proposal and doing the research, drones were predominantly consumer-oriented, with the capability of handling a camera. They were user-operated over short distance. And they were completely unusable for carrying heavy loads like fire retardant.

But war is often the engine of change. And the war in Ukraine launched by Russia has resulted in a literal blitzkrieg of drone innovation and reduced cost of payload. This price to payload ratio is the key to affordable drone fire-fighting capability. After all, a cheap $2,000US drone targeting a small under-canopy fire is now much more cost-effective than a helicopter dropping fluids from above which may or may not work. As stated in the article, “A drone gives a lot of bang for the buck, as utterly new weapons often do.”

NATO has also announced a new $1B fund for defense and security startups. Expect to see startups focused on cyber-security, drone technology, and non-interceptible command and control hardware and software to take the lead here.

Translating weapons of war to consumer products is often challenging. However, drones have gone from consumer toys to weapons of war capable of carrying heavy payloads. So it is much more feasible to move them back to peaceful purposes like fire fighting.

It is as important to keep the peace as it is to make war. And climate change is not simply a war we can win or lose and walk away. We can only adapt. Or die.